20+ prime rate mortgage

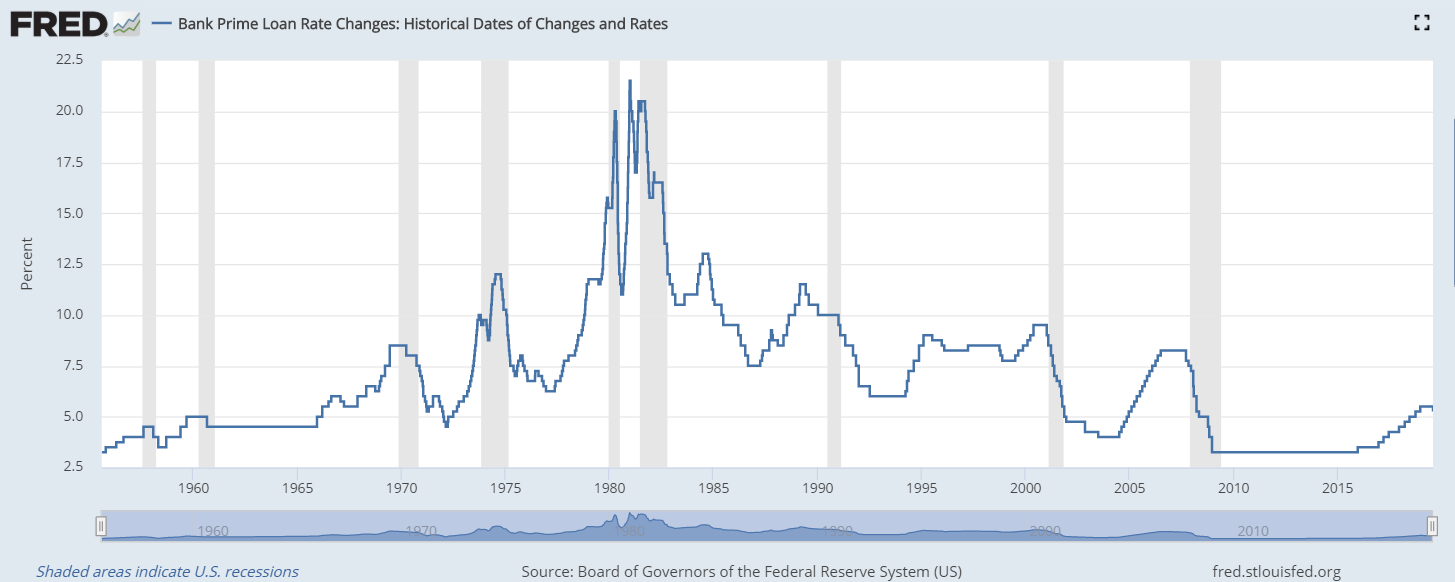

While 10-year mortgage refinance rates rested since yesterday 15- 20- and 30-year rates have risen. The prime rate normally runs three percentage points above the central banks federal funds rate which the Fed has raised to a target range of between 450 to 475.

Sam Fogell Sur Linkedin Contact Me If You Re Looking For Mortgage Rates In The 8s Save Your

March 07 2023 What is Prime Rate.

. Call today at 714 695-5899. On a 200000 mortgage you would make monthly payments of 126414. To find a personalized mortgage rate talk to your local mortgage broker or use an online mortgage service.

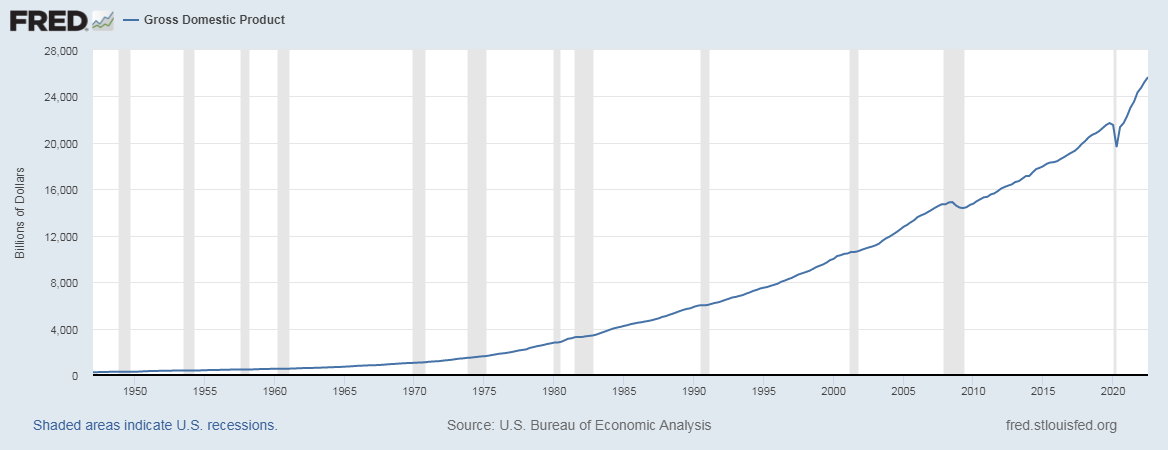

Web How its used. Web After a historical rate plunge in August 2021 mortgage rates skyrocketed in the first half of 2022. 300 -080 220.

This source aggregates the most common prime rates charged. If you see that the prime rate has gone. An interest rate of 650 6802 APR is for the cost of 1875 point s 375000 paid at closing.

How to shop for the best mortgage rate. Web During times of high mortgage rate volatility homebuyers would greatly benefit from shopping for additional rate quotes. Web If the prime rate is 30 and you get a variable-rate mortgage at prime minus 08 your effective interest rate will be 22.

Annual Percentage Rate APR represents the true yearly cost of your loan including any fees or costs in addition to the actual interest you pay to the lender. The Fed has been steadily raising rates since March 2022 to combat inflation spurred on by factors such as increased. Web The current prime rate among major US.

The actual payment amount will be greater. Web Royal Bank of Canada prime rate is an annual variable rate of interest announced by Royal Bank of Canada from time to time as its prime rate. Indeed the 30-year averages mid-June peak of 638 was almost 35 percentage points above its.

Web What this means. Web Current Mortgage and Refinance Rates. Our research concludes that homebuyers can potentially save 600 to 1200 annually by taking the time to shop among multiple lenders.

The mortgage rates below are sample rates based on assumptions. Using a supported browser will provide a better experience. The APR may be increased after the closing date for adjustable-rate mortgage ARM loans.

Many small business loans are also indexed to the Prime. Web 30-year Fixed-Rate Loan. Web Rates as of Jan.

Prime rate - discount to prime rate your mortgage rate. Use our calculator to see estimated rates today for mortgage and refinance loans based on your specific needs. The prime rate is an important index used by banks to set rates on many consumer loan products such as credit cards or auto loans.

Legal Disclaimer 4 This rate is only available to customers with less than 20 down payment purchasing a residential property valued at under 1000000 who are eligible for and purchase mortgage. Web As of May 12 2022 the prime rate reported by the Wall Street Journal was 4. Web We no longer support this browser.

Web With Prime Mortgage you can rest easy knowing you have a trusted brand when it comes to your home mortgage. Monthly payment does not include taxes and insurance premiums. Web The prime rate is the underlying index for most credit cards home equity loans and lines of credit auto loans and personal loans.

Web 775 Effective as of. Web As of February 2 2023 the current prime rate is 775 in the US according to The Wall Street Journals Money Rates table. Thirty-year rates spiked by more than a quarter of a percentage point and.

The Prime Rate is the interest rate that banks use as a basis to set rates for different types of loans credit cards and lines of credit. The prime rate can rise and fall over time and variable-rate loans will rise and fall with it. Your original mortgage rate.

Were proud to serve California with the best mortgage rates available. Web Compare current adjustable-rate mortgage ARM rates to find the best rate for you. Apply Online with Rocket Mortgage Get approved with Rocket Mortgage and do it all online.

For a point of comparison thats up from 325 earlier this year rising in tandem with the federal funds rate. Web A 20-year fixed-rate mortgage is a home loan that maintains the same interest rate and monthly principal-and-interest payment over a 20-year loan period. Lock in your rate today and see how much you can save.

Certain mortgage rates like variable rate mortgages home equity loans and home equity lines of credit may also be affected by the published rate.

Mortgage Crash To Smash House Prices Lower Macrobusiness

Housing Loans And Interest Rates 1990 2008 Source Bank Of Korea Download Scientific Diagram

Ecb Rates Are On The Rise What Does This Mean For Mortgage Holders

The Prime Rate What It Is Why It Matters

Current Prime Rate Commerce Bank

Prime Rate Definition

7 Prime Interest Rate Unsustainable Interest Rates Should Crash Within 1 2 Years Out Seeking Alpha

U S Residential Mortgage Delinquency Rates Download Scientific Diagram

Interestrates Explore Facebook

It S Time For A Fixed Rate Ratespy Com

What Is The Prime Rate

Home Loan Interest Rate Best Home Loan How To Maximise Benefits In New Interest Rate Regime

How Existing Borrowers Can Reduce Their Home Loan Interest Rates The Economic Times

Interbank Overnight Lending Rate Overnight Deposit Window Rate And Download Scientific Diagram

Housing Bubble Woes Mortgage Demand Plunges Rates Near 7 Spread Between Mortgage Rate 10 Year Treasury Yield Blows Out Most Since Dec 2008 And 1986 Wolf Street

Hdfc Home Loan Rate Hdfc Hikes Home Loan Rate For The Third Time In A Month The Economic Times

Treasury Bond Massacre Mortgage Rates Hit 5 35 Highest Since 2009 And It S Only April Wolf Street